top of page

GNCDC NEWS

Monthly Newsletter February 2026 Click Here

City of Chicago SBIF Program Click here for more dates

Small Business Improvement Fund (SBIF)

Learn more at Feb. 3 webinar

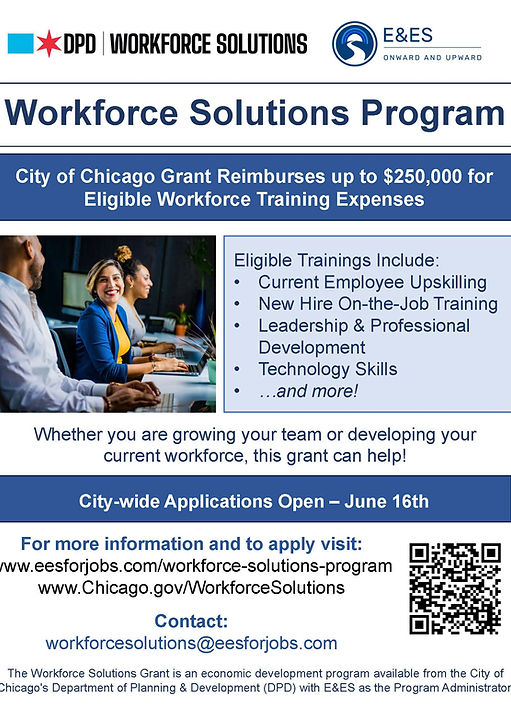

Interested in the Workforce Solutions program? Learn more at an informational webinar at 10 a.m. on Tuesday, Feb. 3. Registration is open now via Zoom.

_edited.png)

IMEC announces new webinars for 2025 to address all aspects of business for Illinois Manufacturers.

Greater Northwest Chicago Development Corporation

4506 W. Fullerton Ave

Chicago, IL 60639

Phone: (773) 637-2416

Proudly, A LIRI and a 501(c)(3) non-profit, GNCDC Reaches Out with Programs & incentives in our community – Since 1977 to effect local industrial retention & small business growth.

bottom of page